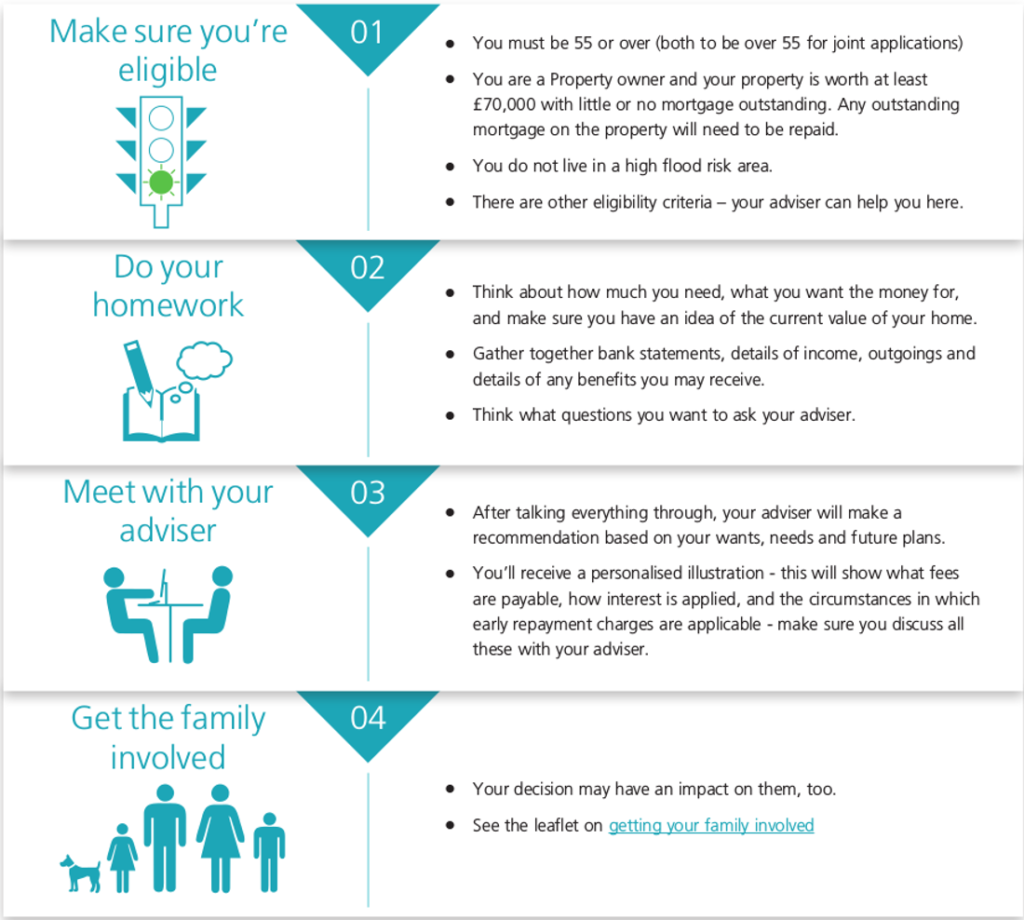

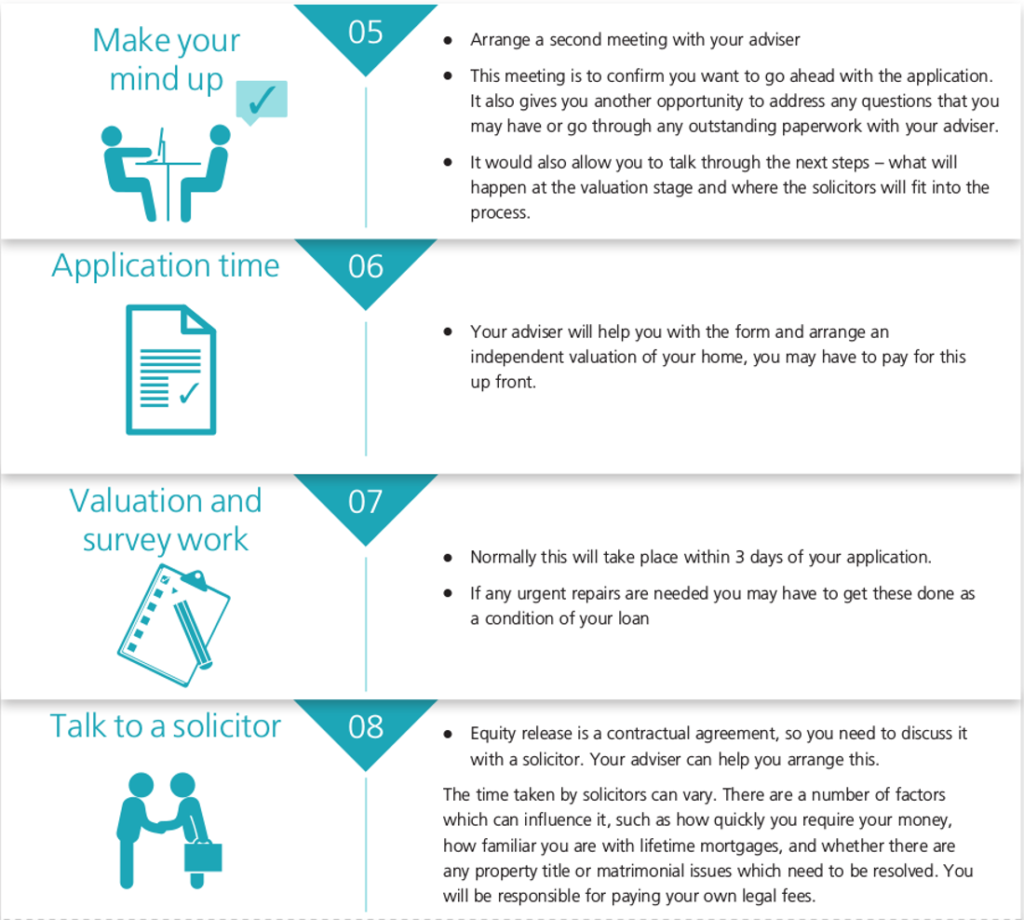

How to get the most from our meeting:

Equity release can help you to unlock some of the value in your home, potentially to help you fund your lifestyle once you’ve retired. But it isn’t for everyone: some people won’t be eligible and even those who do qualify need to make sure that equity release is the right choice for themselves and their family. This is why you’re obliged to get professional advice before making a decision.

This is a lifetime mortgage. To understand the features and risks, ask for a personalised illustration.

To make sure that you get the most from your meeting, it’s worth thinking carefully about what you need to do ahead of your appointment, as well as the questions you need to ask and the type of help you can expect from me. You should also be prepared to discuss alternatives to equity release – you might find there are other ways of planning for your retirement which will work for you. It’s important to know what all your potential options are..

There are two equity release options:

Lifetime mortgage: you take out a mortgage secured on your property provided it is your main residence, while retaining ownership. You can choose to ring-fence some of the value of your property as an inheritance for your family. You can choose to make repayments or let the interest roll-up. The loan amount and any accrued interest is paid back when you die or when you move into long-term care.

Home reversion: you sell part or all of your home to a home reversion provider in return for a lump sum or regular payments. You have the right to continue living in the property until you die, rent free, but you have to agree to maintain and insure it. You can ring-fence a percentage of your property for later use, possibly for inheritance. The percentage you retain will always remain the same regardless of the change in property values, unless you decide to take further cash releases. At the end of the plan your property is sold and the sale proceeds are shared according to the remaining proportions of ownership.

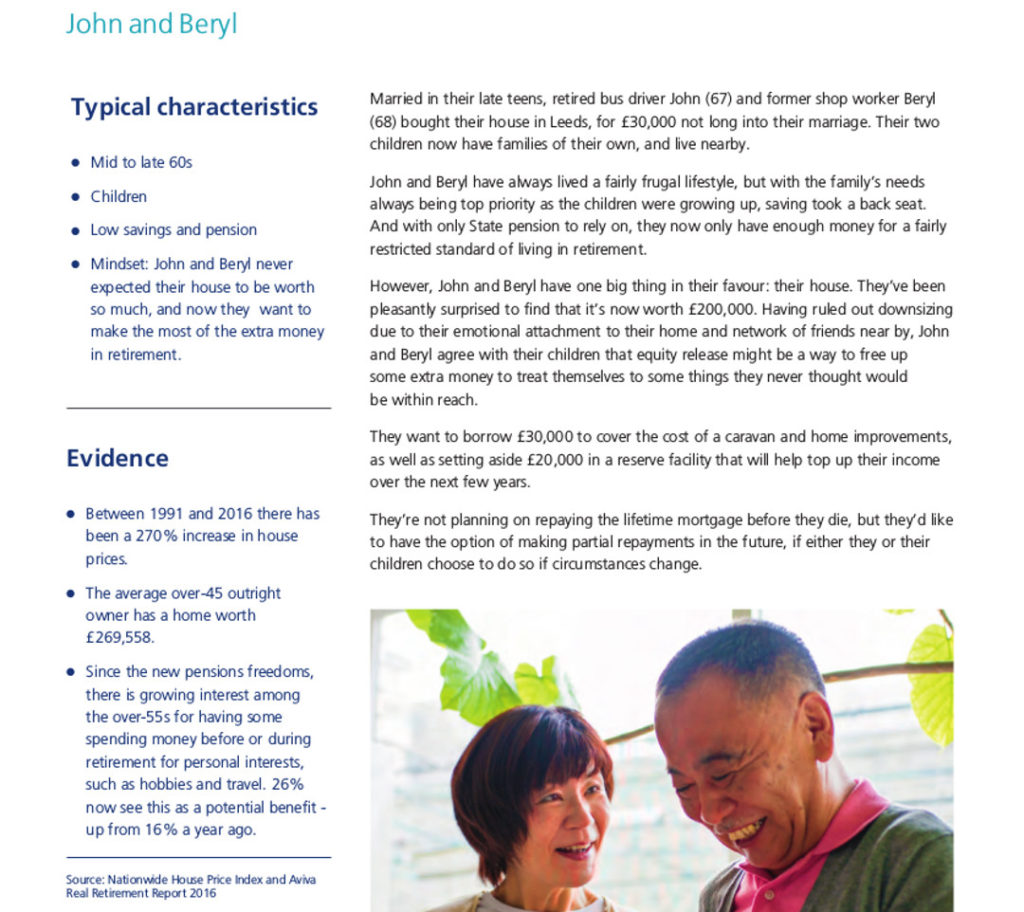

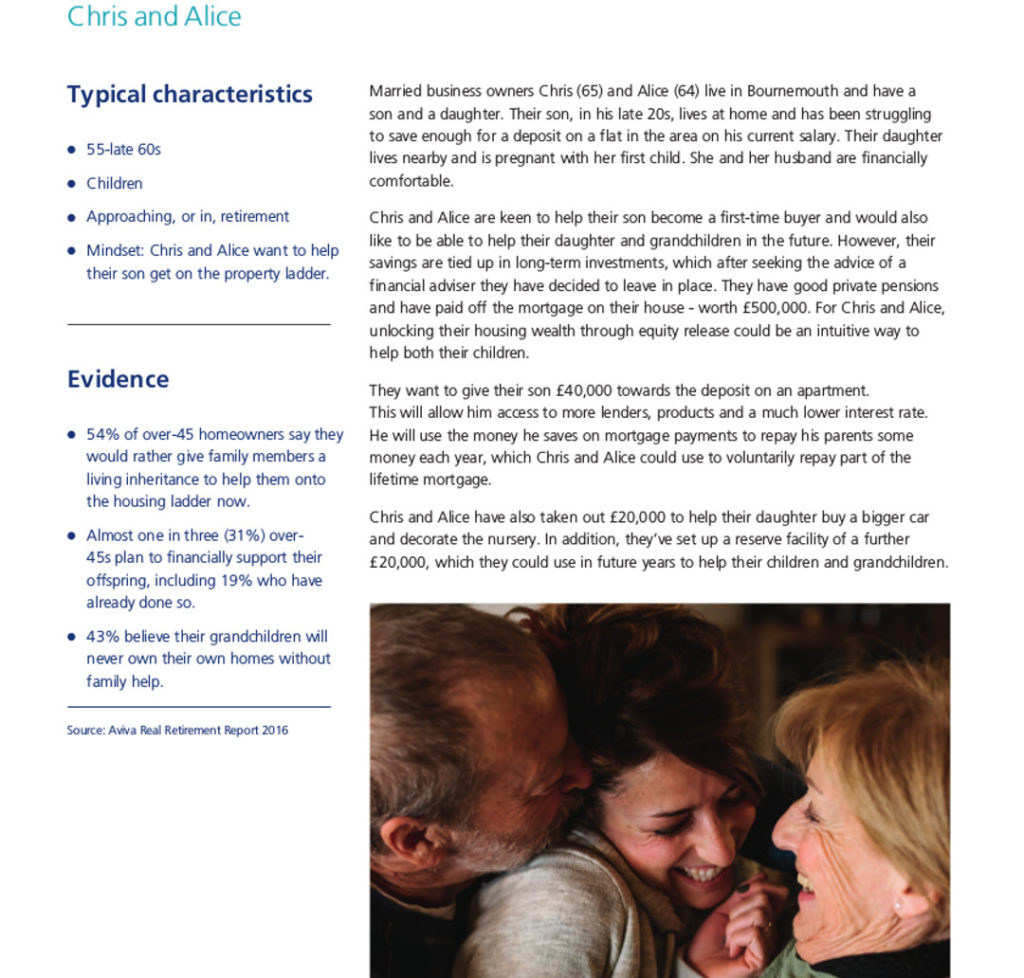

To help you evaluate the options here are some case studies.

- Home Reversion

- Lifetime Mortgage

- I want to balance income with inheritance

- I want to maximise annuity income

- Over 65